Finance Use Cases for Sheetloom

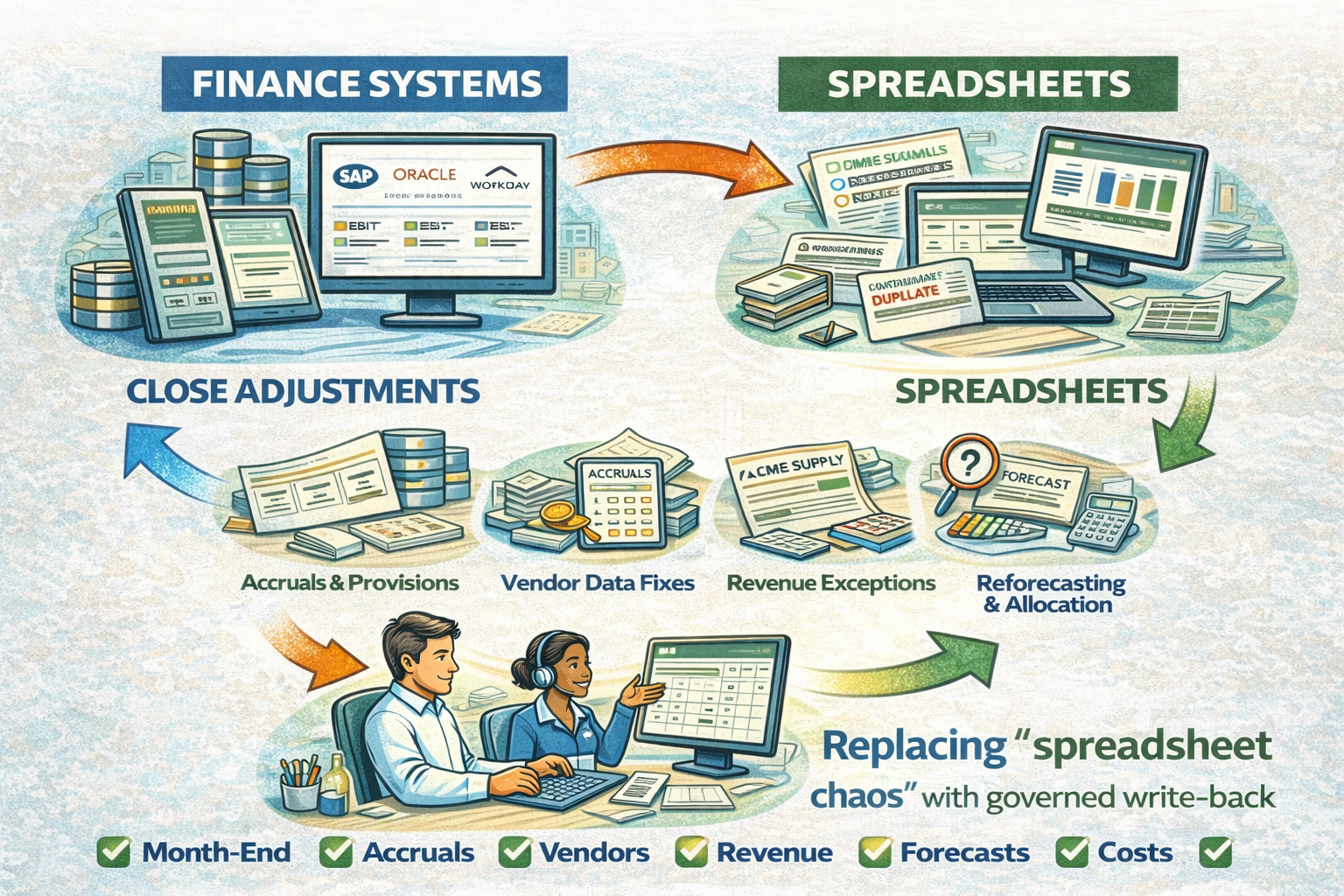

In most finance organisations, core systems handle transactions well — but human judgement still happens outside those systems. Spreadsheets become the de-facto interface for corrections, exceptions, and decisions, before updates are manually re-entered (or not).

Sheetloom formalises this reality by safely connecting system data ↔ spreadsheets ↔ human correction ↔ write-back.

Below are six common finance use cases where this pattern delivers immediate value.

1. Month-End Close Adjustments

Problem

During close, finance teams identify misclassifications, timing differences, and missing entries. These adjustments are often tracked in offline spreadsheets and manually rekeyed as journals, increasing risk and delay.

Sheetloom Flow

- Trial balance, journals, or account balances are pulled into a spreadsheet

- Accountants make close adjustments directly in the sheet

- Approved changes are written back as journals to the GL

Value

- Faster close cycles

- Reduced rekeying errors

- Clear audit trail from adjustment to posting

2. Accruals & Provisions Management

Problem

ERP accruals are based on rules or historical patterns, but business reality changes faster than systems can infer.

Sheetloom Flow

- Accrual and provision lines are exported to spreadsheets

- Budget owners or finance partners update expected values

- Adjusted accruals are written back to finance systems

Value

- More accurate financials

- Fewer “plug” numbers

- Better collaboration between finance and the business

3. Vendor Master Data Cleanup

Problem

Vendor records accumulate duplicates, incorrect payment terms, and outdated bank details. Fixing them usually requires tickets or elevated system access.

Sheetloom Flow

- Vendor master data is pulled into a spreadsheet

- AP or finance teams correct and de-duplicate records

- Validated updates are written back to the ERP

Value

- Cleaner master data

- Faster remediation without risky access

- Fewer payment and reconciliation issues

4. Revenue Recognition Exceptions

Problem

Rev-rec engines struggle with contract amendments, one-offs, and edge cases that require judgement.

Sheetloom Flow

- Revenue schedules and contracts are exported to spreadsheets

- Finance flags exceptions or adjusts timing and amounts

- Approved changes are written back to rev-rec or ERP systems

Value

- Better compliance

- Faster handling of exceptions

- Reduced manual workarounds

5. Forecasting & Reforecasting

Problem

Planning systems lag behind reality as actuals change, pipeline shifts, or costs move unexpectedly. Finance resorts to parallel spreadsheet models.

Sheetloom Flow

- Actuals and forecast data are combined in a spreadsheet

- Finance updates forecasts based on latest insight

- Changes are written back to planning or finance systems

Value

- One source of truth

- Faster reforecast cycles

- Less shadow modelling

6. Cost Centre & Budget Reallocations

Problem

Costs frequently land in the wrong cost centre or project, but correcting them creates a finance bottleneck.

Sheetloom Flow

- Transactions are exported into spreadsheets

- Budget owners correct allocations

- Reclassification journals are written back automatically

Value

- Faster corrections

- Reduced finance workload

- Improved ownership and accountability

Why This Pattern Works for Finance

Finance teams already rely on spreadsheets for judgement and collaboration. Sheetloom doesn’t replace finance systems — it connects them safely to how finance actually works.

The result:

- Faster cycles

- Fewer errors

- Stronger governance

- Lower operational risk

Spreadsheets stop being a liability and become a governed interface.