Why Sheetloom for the Insurance Industry

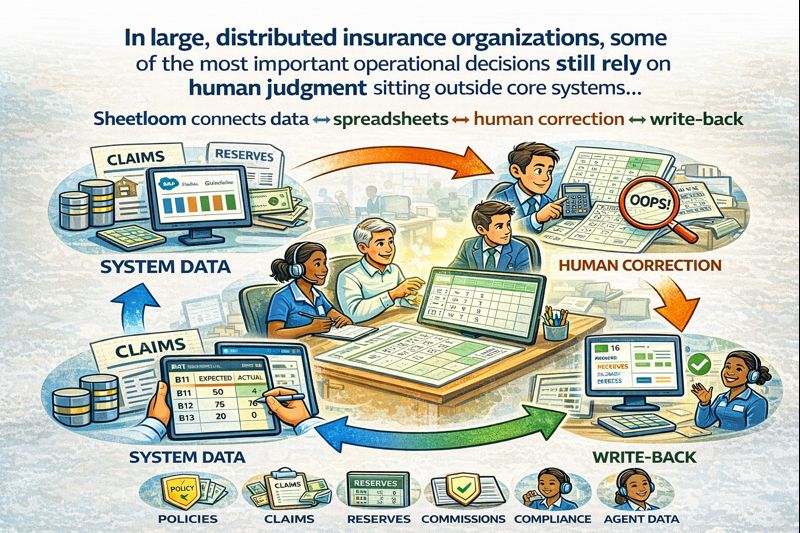

In large distributed insurance organisations, many of the most important operational decisions still rely on human judgement sitting outside core systems. Claims, reserves, policies, commissions, compliance, and agent data are all areas where reality changes faster than system records can keep up. As a result, spreadsheets quietly become the working layer where corrections are identified, discussed, and agreed — before being manually re-entered, delayed, or sometimes lost altogether.

The following use cases show how Sheetloom formalises this already-existing pattern, safely connecting system data to spreadsheets, enabling human correction at the edge, and writing validated updates back into core insurance platforms with control, auditability, and speed.

Sheetloom Insurance Use Cases

1. Claims Triage & Data Correction

Problem:

Claims data is often captured quickly by distributed teams and field adjusters, leading to misclassifications, missing fields, or incorrect loss codes that slow down downstream processing.

Sheetloom Flow:

- Open claims data is pulled from the claims system into a spreadsheet

- Adjusters review and correct classifications, loss codes, and key attributes

- Approved updates are written back to the claims system

Value:

- Faster claim progression

- Reduced rework and back-office bottlenecks

- Lower claim leakage

2. Reserve Reviews & Adjustments

Problem:

Reserve adequacy reviews rely on expert judgement, but adjustments are commonly tracked offline and manually re-entered, increasing risk and delay.

Sheetloom Flow:

- Reserve positions are extracted into spreadsheets

- Supervisors adjust reserve amounts with comments and approvals

- Changes are written back to finance and reserving systems

Value:

- Faster reserve cycles

- Improved auditability

- Reduced reconciliation effort

3. Policy Endorsements & Exception Handling

Problem:

Policy exceptions and endorsements often fall outside standard system rules, forcing underwriters into manual workarounds.

Sheetloom Flow:

- Policies requiring review are exported into spreadsheets

- Underwriters apply corrections to terms, limits, or coverage

- Approved changes are written back to policy administration systems

Value:

- Shorter policy turnaround times

- Better handling of edge cases

- Reduced dependency on central operations teams

4. Broker & Agent Master Data Management

Problem:

Agent and broker records frequently drift out of date, causing compliance issues, payment errors, and operational friction.

Sheetloom Flow:

- Agent master data is pulled into spreadsheets

- Regional teams update licenses, contact details, and commission splits

- Validated changes are written back to core systems

Value:

- Cleaner master data

- Faster onboarding and updates

- Fewer downstream payment issues

5. Commission & Incentive Adjustments

Problem:

Commission systems struggle with disputes, exceptions, and one-off adjustments that require human intervention.

Sheetloom Flow:

- Commission statements are extracted into spreadsheets

- Finance or sales ops teams adjust payouts

- Approved corrections are written back to commission engines

Value:

- Faster dispute resolution

- Improved agent trust

- Reduced manual journal entries

6. Fraud Investigation & Case Management

Problem:

Fraud indicators require expert review and consistent handling across geographically distributed investigation teams.

Sheetloom Flow:

- Flagged claims are pulled into spreadsheets

- Investigators annotate, escalate, or clear cases

- Status updates are written back to fraud systems

Value:

- Faster case throughput

- Consistent decision-making

- Better fraud detection outcomes

7. Regulatory & Compliance Attestations

Problem:

Regulatory requirements vary by state or region, making centralized compliance tracking slow and error-prone.

Sheetloom Flow:

- Compliance datasets are exported by jurisdiction

- Local compliance officers update attestations in spreadsheets

- Confirmed data is written back to central compliance systems

Value:

- Reduced regulatory risk

- Faster compliance cycles

- Less manual consolidation effort

8. Enterprise Data Quality Remediation

Problem:

Data quality issues accumulate across systems, but ownership is often distributed and correction processes are ticket-based and slow.

Sheetloom Flow:

- Data quality exceptions are extracted into spreadsheets

- Local teams correct the data they own

- Fixes are written back to source systems

Value:

- Higher overall data quality

- Lower operational friction

- Faster root-cause resolution